If you do have to use your emergency fund make sure you start topping it back up as soon as you can. Current Expenses Calculator: Use this tool to calculate the total monthly and annual expenses for you and the family members for whom you are financially. It might take time to reach the target you set, but every dollar you put away is one you won’t need to find next time you experience a financial shock.

If you use the CommBank app and have a NetBank Saver or GoalSaver account, you can set this up using Goal Tracker. You can set up an emergency fund or a rainy day fund by setting up a scheduled payment into a new account. Your emergency fund is different to your regular savings, so you may want to use a separate bank account to make sure you don’t accidently dip into it.

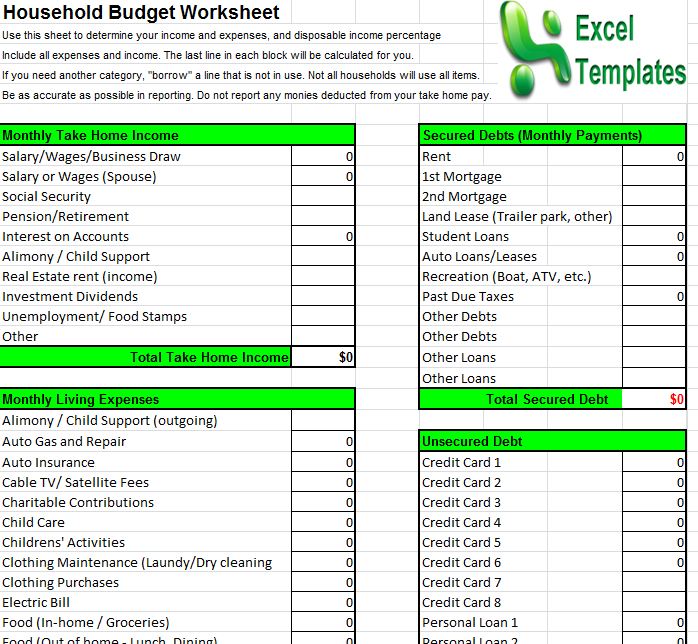

Well give you a breakdown of your finances and provide some great tips and support that could help get you towards. Add your income - this can be your own or household. This fund should be separate to your rainy day fund, which you may dip into every now and then for expenses you can’t quite predict. Tell us what your goal is - it helps us to know what you are planning for. It’s important to work out when you will let yourself break your emergency fund, so you have the money you need when an emergency happens. That way you can cover living costs for you and your family while you work out your next steps. If you have a mortgage and financial dependents, you might want to aim to have three to six months of expenses in your rainy day fund. This will allow you to continue to cover costs for about three months while you work out a plan if an emergency strikes. Once you have met your first target, continue to build your fund so you have about three months’ worth of living expenses as an emergency buffer. Look at your budget to work out how much you need for to meet your obligations, then consider how much you would need to keep up your current lifestyle without having to borrow. Standard men's haircut in expat area of the cityīasic dinner out for two in neighborhood pubĢ tickets to the theater (best available seats)ĭinner for two at an italian restaurant in the expat area including appetisers, main course, wine and dessertġ beer in neighbourhood pub (500ml or 1pt.)ġ min.If you are just getting started, aim to set aside a minimum of one month worth of expenses for your emergency fund. Short visit to private doctor (15 minutes) Volkswagen golf 1.4 tsi 150 cv (or equivalent), with no extras, newĬold medicine for 6 days (tylenol, frenadol, coldrex, or equivalent brands) Microwave 800/900 watt (bosch, panasonic, lg, sharp, or equivalent brands)ġ summer dress in a high street store (zara, h&m or similar retailers)ġ pair of sport shoes (nike, adidas, or equivalent brands) ) for 1 person in 45 m2 (480 sqft) studio Utilities 1 month (heating, electricity, gas.

6 months living expenses calculator tv#

Monthly rent for a 45 m2 (480 sqft) furnished studio in normal area Week 5 Expenses Week 4 Expenses Week 3 Expenses Week 2 Expenses Week 1 Expenses Personal Budget Worksheet Read Me Expenses: Week 1, Month of: Living/Housing: Rent/Mortgage Electric Water/Sewer Gas/Heating Telephone Cable TV Other: Regular Payments: Student Loan Credit Cards Other Loan Payments Health Insurance Car/Home Insurance Life Insurance. Monthly rent for a 45 m2 (480 sqft) furnished studio in expensive area Monthly rent for 85 m2 (900 sqft) furnished accommodation in normal area Monthly rent for 85 m2 (900 sqft) furnished accommodation in expensive area

6 months living expenses calculator mac#

Basic lunchtime menu (including a drink) in the business districtĬombo meal in fast food restaurant (big mac meal or similar)ĥ00 gr (1 lb.) of boneless chicken breastĠ.5 l (16 oz) domestic beer in the supermarket

0 kommentar(er)

0 kommentar(er)